Japanese software to the world through “half-step ahead” technology. The next ten years of ibis begins.

Entering a harvest phase with a robust user base, ibis moves toward its next challenge

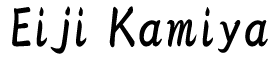

ibis is currently at a clear turning point in its corporate growth. Our flagship product, the mobile paint app “ibisPaint,” has been used worldwide since its release in 2011, surpassing 500 million cumulative downloads globally in September 2025. Our current Monthly Active Users (MAU) have reached approximately 40 million, representing a vital strategic asset for deploying future growth measures. Against the backdrop of this stable user base, we shifted our revenue model at the time of our listing from one centered on advertising to increasing sales through in-app purchases, primarily subscriptions.

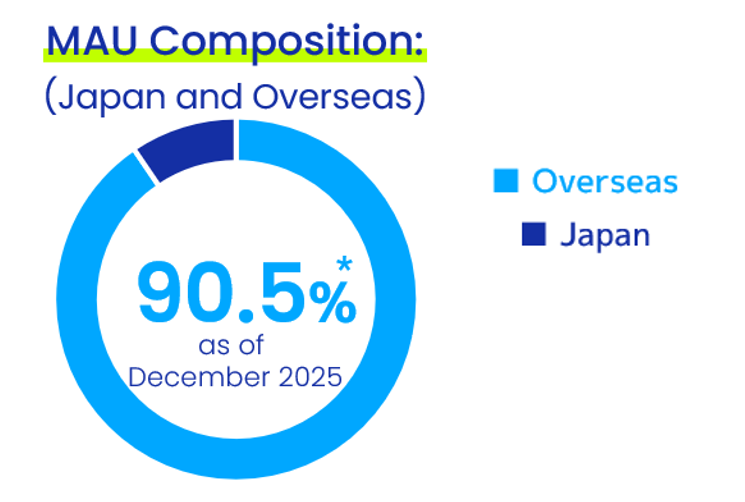

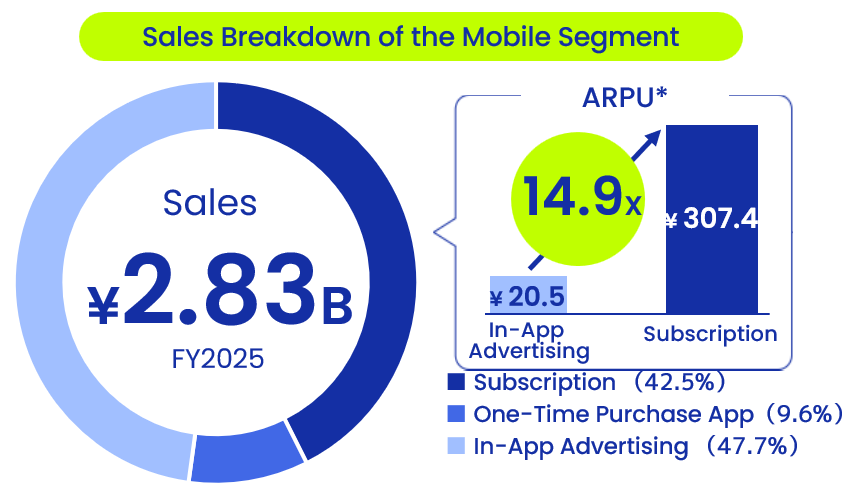

Regarding subscription billing sales, we expect year-on-year growth rates of 175% for the fiscal year ending December 2025 and 144% for the fiscal year ending December 2026. While growth rates will moderate as the denominator expands, the annual increase in sales is expected to be 357 million yen in 2024, 514 million yen in 2025, and 529 million yen in 2026, showing an accelerating pace of growth year by year. Furthermore, we anticipate that the speed of subscription growth and the quality of revenue will further improve from 2027 onward. However, this harvest phase resulting from the reinforcement of our revenue base is not a final destination, but rather a passing point toward our next challenge. We aim to maximize long-term corporate value by continuing to evolve our revenue model without compromising the value of the global user base of drawing and illustration creators.

In an era where the premises of creation are changing, the ibis mission enters a new stage

Our mission, “Delivering “WOW!” Experience on Mobile,” has achieved a certain level of success as ibisPaint has become widely used throughout the world. Being chosen as a tool that supports non-verbal communication through illustration is a major achievement for us and proof that our journey thus far has been accepted by the global community. That said, I believe a mission should evolve in accordance with the company’s growth and the times. In recent years, a generation for whom it is natural to express themselves through “AI + individual effort”—treating AI as a prerequisite for creation and work—is becoming the driving force of society. We intend to stay at the forefront of this change and continue delivering new creative experiences, and we are also considering a revision of our mission with an eye toward the future.

Meanwhile, our vision, “Boost Japanese Tech to the World,” is still a work in progress. While we have established a top global position in the niche field of paint apps, we aim to create even greater value by incorporating new technologies such as AI to establish a presence that is truly world-class. To this end, we will accelerate our efforts toward the next stage of growth by further expanding the reach of ibisPaint and producing a series of hits through new ibisPaint features or new creative products. Our vision is to raise the presence of Japanese software in terms of both quantity and quality.

*January–November 2025, global basis, Monthly Active Users (MAU). Source: Company research.

Organizational structure and decision-making to stay “half-step ahead”

There are unwavering beliefs in the organizational management of ibis. These are: “being a group of experts in advanced technologies,” “maintaining rapid decision-making and execution,” and “embedding continuous challenge into our culture.” While common across various industries, I believe that in the field of software and apps, winning depends on taking that “half-step ahead.” If you enter the market late, our chances of success decline. This is why we need a system that constantly builds on small challenges.

Internally, we have established an internal proposal system where functional proposals are continuously submitted from the front lines. In addition to the development of new features, projects such as maintenance and bug fixes, as well as development for collaborations or analysis, are constantly accumulating. Alongside these, ideas from the internal proposal system are considered on the same level, and we move forward while constantly updating priorities. Our principle of decision-making is simple: choose the challenge we have never tried before, and if short-term and long-term interests compete, prioritize the long-term. Continuing to make choices that lead to the next 10 years is our belief and the value we provide to society.

Enhancing the value of our product portfolio centered on the creative field for sustainable growth

Our basic policy for achieving long-term growth in product development is to focus on the creative field and provide next-generation creative experiences through multiple products, including ibisPaint. Rather than competing for share in large, already mature markets, we will continue to identify areas where we can win and maintain a leading position. Based on the technical capabilities and marketing strategies cultivated through ibisPaint, we will continuously create new creative products and aim for significant growth in sales and business scale by enhancing the value of the entire product portfolio through mutual synergies such as functional integration.

This concept continues the growth strategy of ibisPaint to date. We built up a core user base worldwide through a freemium model and switched to strengthening subscriptions at the time of our listing. Anticipating the saturation of MAU, we had been preparing for the harvest phase even before listing. This was a choice to increase long-term corporate value rather than focusing on short-term numbers. We will work steadily toward a future where “Japanese software shows its presence in the world” ten years from now, drawing a roadmap to realize that vision.

Next-generation monetization design: Subscriptions x Pay-as-you-go x AI

With a view toward sustainable medium- to long-term growth, we are also steadily advancing our immediate growth strategies. The monetization design of ibisPaint will further evolve with subscriptions as the foundation. We recognize that strengthening subscription sales, which have a profit margin approximately 14 times that of advertising sales, is one of our most important tasks, and we are continuing to develop features that increase retention rates.

Furthermore, we will introduce pay-as-you-go pricing that allows users to use only the features they need and pay only for what they use. In addition to the affordable monthly subscription of 300 yen, a billing system that responds to the value of new features and services will expand the breadth and depth of creative activities. New features powered by AI, in particular, are highly compatible with pay-as-you-go pricing where users pay per use. By creating a design where value and price are aligned, we aim to increase the revenue per user. Regarding the use of AI, while respecting various discussions during this transition period, we will ultimately proceed based on the criteria of how we can better improve the user’s creative environment, such as by enhancing the creative experience and improving work efficiency. The use of AI in work and hobbies is already becoming commonplace. We will utilize it a half-step ahead without fear of change and return that value to users a half-step ahead. Centered on our large asset of 40 million MAU, we will draw a growth curve toward the next phase by overlapping subscriptions, pay-as-you-go pricing, and AI development.

M&A strategy: Buying time to accelerate growth

While expanding growth through existing assets like ibisPaint, we are also working to accelerate growth through M&A. We began considering this in the spring of 2024 and executed it in 2025. To achieve significant sales expansion in the medium to long term, there are limits to time and human resources. Therefore, we have chosen to increase growth speed by bringing in companies with synergies. The aim of our M&A is consistently “synergy.” In 2025, in the smartphone app field which is highly compatible with ibisPaint, we added Techno-Speech, Inc. to the group—a company where we can expect synergistic effects in the context of creative culture through their singing voice synthesis business. Following this, through collaboration with the AI singing voice synthesis app “VoiSona,” we are moving forward with gradual initiatives toward realizing a new production experience that crosses video and music, such as combining musical expression with illustration and video production.

Furthermore, through the acquisition of Zeroichi Start Inc., a no-code development company in our Solutions Business, we aim to shorten development periods, reduce costs, and improve profit margins by complementing our sales capabilities.

M&A is a strategy to “buy time,” acknowledging the reality that we cannot increase personnel all at once. We will continue to evaluate the balance between investment pace and growth speed as we move forward with further considerations.

Toward the next 10 years: Bringing Japanese technology to the world and aiming for the Prime Market

Since our listing on the Growth Market in March 2023, our credibility in corporate sales and our recruitment power have increased, and our foundation as a company, including compliance and governance systems, has steadily evolved. Our next goal is growth with a view toward stepping up to the Prime Market. Looking toward long-term growth, we will aim for sustainable growth while improving profitability and strengthening our business foundation over a three- to five-year span. Centered on our user base of 40 million MAU, we will draw a sustainable and reproducible growth curve by layering AI utilization, the evolution of pay-as-you-go pricing, and synergies from M&A.

For ibis, “challenge” is not a means, but the essence itself. In ten years, we will seriously realize a future where Japanese software shows a solid presence in the world. We would be grateful if you would continue to watch over our progress from a long-term perspective.